THE JOURNAL

Cash Book

Sales Day Book

Puchases Day Book

Returns Inwards Day Book

Returns Outwards Day Book

Any transactions that DO NOT FIT into any of these day book, are entered into The Journal.

So... What is Journal?

It is a book used to recorded rare or exceptional transactions that do not appear in other books. It should look something like...

Why would we use a Journal?

1. The Purchase or Sale of FIXED ASSET on credit

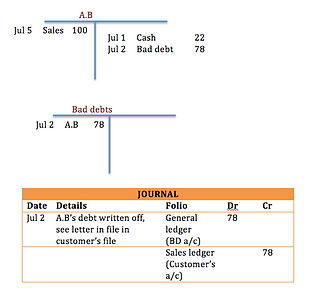

2. Writing off BAD DEBTS

3. ADJUSTMENTS to any of the entries on the ledgers.

4. CORRECTIONS from any of the other ledgers.

5. OPENING ENTRIES.

FAB-DAc-oe

'EASY WAY TO REMEMBER'

1. the purchase or sale of fixed asset on credit

The transactions involves the acquisition of an asset and a liability.

2. writing off bad debts

When a debts turns bad, we have to stop classing it as an asset and class it as an expense.

3. adjustments to any of the entries in the ledgers

To match expenses to revenue in the accounting period in which they occur.

Blair (a debtor) owed 2000. She was unable to pay her account, however offered her car as payment to settle the debt. Her personal a/c has been settle and now the business has a new asset.

4. corrections from any of the other ledgers

To make corrections depends on the problem.(eg. Entered into wrong a/c)

Jack paid us a cheque of 100 on May 18. The transaction was correctly recorded in the cash book, but was incorrectly taken out of Jackson's a/c

The error was found on May 31.

Debit Jackson's a/c to cancel out the error on the credit side of his a/c

Credit Jack's a/c to enter the cheque

5. opening entries

Some people who operate as a soletrader do not ise accounting to record their transactions.

This often causes many problems. So often, after the business is established, the owner will start using accounting to help the business operate smoothly.

We use the journal as a starting point.